What We Do

We are a purpose-driven company benefiting businesses and communities, independently or through Corporate Social Responsibility-focused partnerships.

We empower Supply Chain Finance with Independent, State-of-the-Art Technology.

We leverage our expertise in commerce & finance to create innovative trade finance solutions.

Our innovative business model and system is a game changer.

Our Mission – To be a blessing

Our Values – To act justly, love tenderly and walk humbly with God

If your company has:

(1) surplus cash (or access to credit facilities), and

(2) a large supplier base

![]()

By using AP&R reverse factoring platform, you will unlock a new recurring stream of financial income

What is AP&R reverse factoring model?

It involves an anchor buyer using cash to buyback its Account Payables (aggregate of its suppliers’ receivables) with early payment

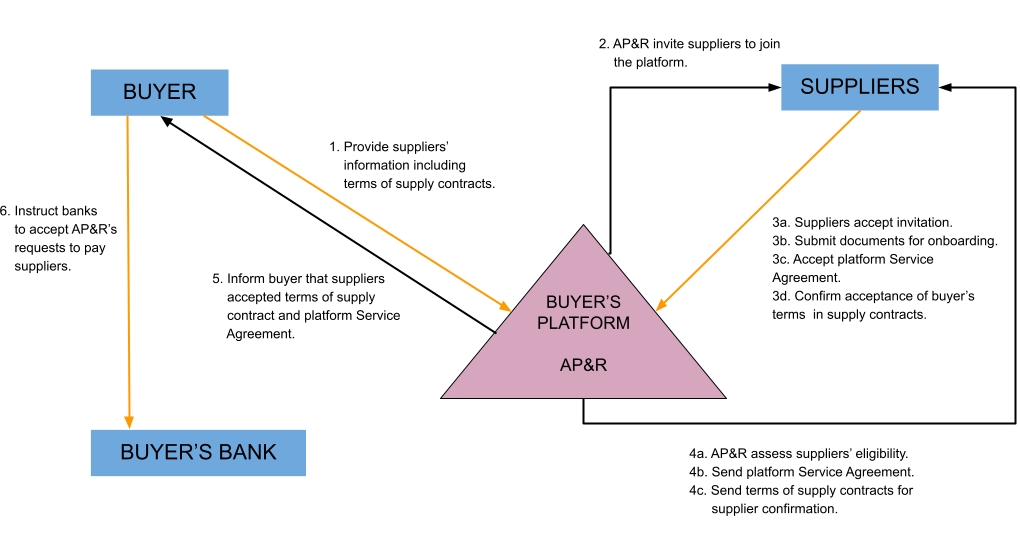

THE ONBOARDING PROCESS

(Branded Private Platform Available)

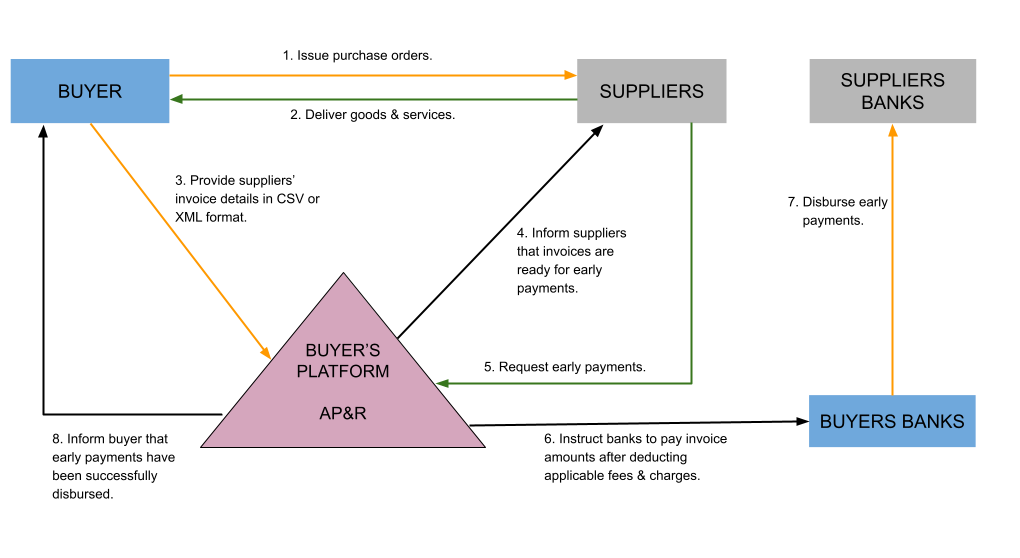

The Funding Process

(Branded Private Platform Available)

Settlement – What Buyer Pays & Suppliers Receive

Assumptions:

– Invoice value is $100.00

– Discount rate is 12% per annum or 1% for 30 days

– Supplier give to Anchor Buyer 90 days’ credit

Buyer’s New Financial Income

| Discount charge calculated at 12% pa for 90 days | 3% |

| New Financial Income | $3.00 |

| Less: Platform Fee | $ – |

| Buyer’s New Financial Income | $3.00 |

Buyer pay Supplier directly through its bank

| Invoice Value | $100.00 |

| Less: Discount charge at 12 % pa (assume 90 day’s credit ) | $3.00 |

| Supplier’s platform paid to AP&R | $0.75 |

| Supplier receive from Buyer | $96.25 |

You Get To Enjoy These Benefits

It involves an anchor buyer using cash to buyback its Account Payables (aggregate of its suppliers’ receivables) with early payment

FOR BUYERS:

• Unlock Financial Income from Supply Chain to Enhance Valuation

▸ Buy selectively supplier receivables of your choice

• Optimise Surplus Cash

▸ Earn superior returns vs. traditional deposits

• Automate & Streamline

▸ Digital platform’s real-time visibility eliminates suppliers chasing for payments.

• Strengthen Supplier Trust

▸ Ensure timely, automated payments to enjoy better pricing from suppliers

• Enable Scalable Growth

▸ Fintech-enabled, scalable architecture

• Flexible and Free Platform Access

▸ No subscriptions

FOR SUPPLIERS:

• Fair & Transparent Terms

▸ No pressure for extended payment terms or dynamic discounting

• No Bank Dependency

▸ No credit checks, high interest rates, or penalty fees

• Flexible Cash Flow Access

▸ Early payments on selected invoices at lower costs than traditional factoring

• Full Invoice Value at Low Fees

▸ Fixed fee of 0.75% or $0.75 per $100 invoice sold to buyer

• Lower Financing Costs

▸ Leverage buyer’s credit profile for better rates

• Preserve Credit Headroom

▸ Existing credit lines with banks remain unaffected

• Growth Enabler

▸ Operate at full capacity and redirect resources to R&D

• Digital & Mobile

▸ Real-time visibility and access via mobile devices

AP&R PLATFORM: KEY RISKS & MITIGATIONS

It involves an anchor buyer using cash to buyback its Account Payables (aggregate of its suppliers’ receivables) with early payment

• Seller Performance Risk

▸ Only onboard buyer-approved sellers

• Fraudulent Invoices

▸ Buyer uploads payables post-delivery/service confirmation

• Contra Risk

▸ Contra sellers are excluded from the program

• Dilution Risk

▸ Alerts for overpayments; daily reports track seller exposure

• Buyer Credit Risk

▸ Mitigated via established trading history

• Data Security

▸ Secure uploads (XML/CSV) with minimal required data

• Platform Stability

▸ Platform holds no funds, lowering operational risk

TRANSPARENCY & ACCOUNTABILITY

- Why it matters: Builds trust and fosters ethical culture.

- How to implement: Share financials, KPIs, and strategy updates via reports and presentations.

RISK MANAGEMENT

- Why it matters: Identifies vulnerabilities impacting financial health.

- How to implement: Use risk assessments, scenario analysis, and stress testing.

REGULATORY COMPLIANCE

- Why it matters: Avoids penalties and protects reputation.

- How to implement: Conduct audits, train employees, and appoint a compliance officer.

STAKEHOLDER ENGAGEMENT

- Why it matters: Drives innovation and customer satisfaction.

- How to implement: Hold surveys, focus groups, and enable two-way communication.